Videos added by Walker & Dunlop - Company and Property Videos

34 videos found

Our mission is to create communities — with ideas and capital — where people live, work, shop, and play.

Learn more at: https://www.walkerdunlop.com/

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 12, 2023| Lending / Finance, Marketing/PR

| Multifamily, ALL

| ALL

Walker & Dunlop launched CREUnited in 2021 to address a systemic lack of diversity in commercial real estate. CREUnited is an alliance of leading CRE firms dedicated to increasing minority participation across the entire commercial real estate industry, with the overarching goal of growing assets under management by underrepresented groups.

Reach out to us at CREUnited@walkerdunlop.com to get more information and to set up a time to talk, or visit our website at https://www.walkerdunlop.com/what-mak... to learn more.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 12, 2023| Lending / Finance, ESG (Environmental, Social and Governance), Employment / Jobs

| ALL

| ALL

Walker & Dunlop is pleased to announce the offering of Eastpointe Lakes: a 1998 built, 252-unit, suburban garden style apartment complex located in Blacklick within the Silicon Heartland corridor.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 05, 2023| Commercial Properties for Sale

| Multifamily

| OHIO

For more than 85 years, our clients have relied on Walker & Dunlop’s ideas and capital to bring their visions of communities across the U.S. to life. Our clients start the communities where people live, work, shop, and play, and we make them possible.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 19, 2023

| Date Created: April 14, 2023| Lending / Finance, Marketing/PR

| Multifamily, ALL

| ALL

Soleste Spring Gardens is a 240-Unit Luxury Mid-Rise Investment Opportunity in Miami, FL

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 19, 2023

| Date Created: March 29, 2023| Commercial Properties for Sale

| Multifamily

| FLORIDA

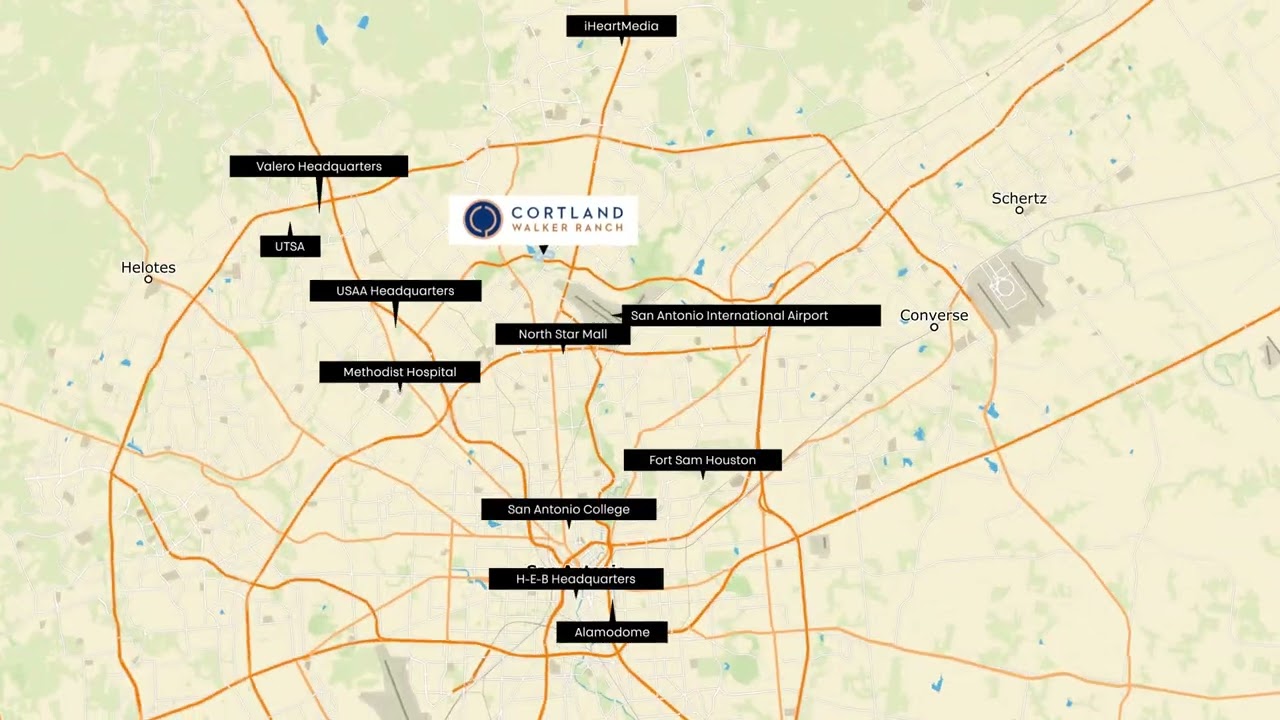

Walker & Dunlop’s Houston Multifamily Investment Sales Team is pleased to announce the exclusive listing of Cortland Walker Ranch, located within the Blanco Road/West Avenue submarket, one of the more desirable areas near the heart of San Antonio.

The community offers top-flight unit amenities in renovated units with the opportunity to continue and complete the renovation program.

Convenient distance to major employers like USAA and University Hospital makes the everyday commute easy, and access to retail at North Star Mall affords residents a low-stress lifestyle

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 19, 2023

| Date Created: March 21, 2023| Commercial Properties for Sale

| Multifamily

| TEXAS

The Guthrie North Gulch (the “Property”) offers investors a rare opportunity to acquire a wood-frame property in the urban submarket of Nashville, TN. The 271-unit community provides residents a luxury product at a significant discount to new construction properties in the Downtown submarket. The Property has not received any significant improvements since construction, allowing a new owner the opportunity to implement light value add upgrades.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: March 14, 2023| Commercial Properties for Sale

| Multifamily

| TENNESSEE

As we navigate the start of 2023, we wanted to give a quick nod to 2022 and all that we accomplished together.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: February 23, 2023| Lending / Finance, Marketing/PR

| Multifamily

| ALL

Today’s webinar is hosted by Ana Ramos. She is the managing director of the West Coast Regional for Walker & Dunlop Small Balance Multifamily Lending Group and has been in the industry for over 20 years. She is joined by panelists Luke Erlandson, Matt Jones, and Scott Doyle to discuss how private investors can navigate the current market for 5-150 multifamily properties.

Luke Erlandson is the Senior Director and the Midwest Production Head for Walker & Dunlop’s Small Balance Group, based in Chicago, and specializes in non-recourse financing solutions. Matt Jones is the Managing Director of Walker & Dunlop’s investment sales team based in Michigan and has 14 years of experience. Scott Doyle has worked in Walker & Dunlop’s investment sales team in the Mid-Atlantic region for three years.

The webinar starts with an overview of the market: deals are getting done, uncertainty among buyers and sellers, and a pessimistic view far from the truth. Financing activity has decreased, but options remain available for private investors, such as Fannie Mae, currently with the best fixed-rate pricing, agency products, flexible pre-pay, full-term interest, maximizing IO term, and Walker & Dunlop (W&D). To get successful loans, borrowers should do everything they can to have strong collections, and push rents as much as possible without affecting occupancy too much. They should also try minimizing and cutting expenses, aiming for the highest net operating income possible. By providing companies like W&D with strong financials, the best product is attainable. Sellers can prepare for the current market by considering occupancy rates remaining high, trade outs toward the top end of the range, and cap rates. It’s also important to have relationships with non-recourse solution specialists, understand the debt market, articulate plans clearly, and provide certainty of execution.

Cap rates are dependent on the product type. Capital buyers have the benefit of getting conviction around the microeconomics of an asset or sub-market. Rates have been macro across the country, and even in tertiary markets like the Midwest, there is still a 7-10% growth in trade-offs. Having the crutch of the US government, the Mid-Atlantic stays consistent at around 3-5% as deals are happening. For investors, rates are in the 5-7% range. W&D can help sellers and buyers have a better grasp of micro and national markets with the resources, tools, and collaboration they develop. They keep debt in-house, and leverage clients to put them in the best deals possible. The difference between W&D and local brokers is that W&D is a direct lending partner with Fannie Mae and Freddie Mac. Credit spreads are higher with the current environment, and everyone’s pricing risk differently, hoping Freddie and Fannie put out all the money allocated to them. Location affects investors’ preferences as many have found success in tertiary markets. When asked which is better, lower cap rates than interest or vice versa, it depends on how much you’re willing to stomach. Increasing default rates next year is likely as there’s potential for people to come in if some borrowers have problems.

Key Points In The Webcast:

02:22 Introduction of panelists

02:49 Overview of the market

05:35 Options for private investors

08:04 Tips for potential borrowers and sellers

11:11 Overview of cap rates

15:40 Services for sellers and buyers

17:41 Why Walker & Dunlop is different

22:06 Benchmark rates projections

23:31 The impact on investors’ preference

26:11 Are lower cap rates vs. interest rates better?

23:15 Increasing default rates on floating bridge loans

34:13 Other asset types

34:24 Refinancing in five vs. ten years

35:32 Deal size for private investors and minimum loans

36:35 Freddie vs. Fannie

39:50 Condo conversion and mortgage brokers

41:31 Green Globe certification and current floating rates

43:44 Closing advice

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: October 25, 2022| Economics/Market Reports/Research, Events / Webinars, Lending / Finance, ESG (Environmental, Social and Governance)

| Multifamily

| ALL

Aven is a 536-unit, 38-story premier core opportunity in South Park, Los Angeles (DTLA).

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: October 12, 2022| Commercial Properties for Sale

| Multifamily

| CALIFORNIA

Today’s webinar is hosted by Alison Williams, Allison Herrera, and Tim Cotter.

Download Webinar Slides: https://explore.walkerdunlop.com/sbl/...

Learn More About Walker & Dunlop Small Balance Lending: https://explore.walkerdunlop.com/sbl/...

Get a Loan Quote for a Five- to 150-Unit Multifamily Property: https://explore.walkerdunlop.com/sbl/...

Alison Williams is the Senior Vice President and Chief Production Officer for Walker & Dunlop. She carries 20 years of real estate experience in the company, previously as a broker and a Senior Director in W&D’s Capital Markets Group.

Allison Herrera, Senior Director and the Midwest Production Head for W&D’s small multifamily lending group, has two decades of commercial real estate work under her belt.

Tim Cotter, a Director at Walker & Dunlop, is responsible for nationwide loan origination and is based out of W&D’s Milwaukee office.

The webinar begins with Tim briefly describing the U.S. Treasury Index and the significant trends over the years. Treasury indexes have doubled a quick run-up in the past six months, and earlier in the week, it peaked at 3.48%, which he attributes to inflation. When asked how many multifamily loans they have closed with a 5% interest rate, 57% of the audience said none. Allison emphasizes that five and seven-year Treasury rates should also be considered and that the experts at Walker & Dunlop are apprised of the impacts and constant Movement of interest rates. The predictions for 2023-2024 remain uncertain, but interest rates are expected to increase in 2022. On the other hand, Alison points out that it is highly critical for investors to work with lenders that can canvass all debt sources. In 2021 alone, Walker & Dunlop sourced transactions from 250 different providers.

The multifamily debt sources are differentiated, starting with Freddie Mac and Fannie Mae. The two are government-sponsored, generally the most attractive, agnostic to economic changes, and focused on providing affordable housing to all. They allow 80% loan, cash-out-of-debt service, flexible prepayment structures, and financing for non-US citizens. Life companies target low-level, institutional quality, well-leased properties in the metropolitan area. Their loans differ depending on the market, as they are willing to stretch for the small and middle space. CMBS is generally “the last resort” for multifamily loans as the goal when utilizing this is to remove as much friction as possible. Bridge financing is geared toward properties that require additional stabilization or rehabilitation funds for upgrading, such as in the case of fire. It is considered a stepping stone to a refinanced permanent loan transaction, and the loans are typically 2-5 years with floating interest rates.

When managing interest rate risks, Allison suggests locking your interest rate when it rises, utilizing Fannie Mae’s practice of holding the rate upon application.

Key Points In The Webcast:

00:00 Introduction

00:40 Alison Williams welcomes Allison Herrera and Tim Cotter

02:31 Overview of the U.S. Treasury Index and factors for fluctuation

05:47 Closed multifamily loans with over 5% interest rates

07:25 Expected rising interest rates for 2022

08:28 Lenders and debt-sourcing

09:31 Freddie Mac, Fannie Mae, and HUD

13:37 Life companies, loan amounts, and CMBS as a last resort

17:02 Bridge financing and pro forma net operating income

18:40 Banks, credit unions, and drawbacks

22:27 Key strategies for managing interest rate risks

25:35 Correlation between cap rates and interest rates

27:37 Advice in achieving higher leverage point for debt

35:20 Optimizing bridge financing with a HUD223(f) loan

35:35 When to use HUD over Fannie Mae and Freddie Mac

39:43 Changes to agency fees and options for non-recourse

41:23 WD financing for other interests and bridge loans for 1031 sales

41:55 Movement of Spreads and best choice for multifamily construction

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: June 17, 2022| Lending / Finance, Interviews / Speeches

| Multifamily

| ALL

In just five years, Mark Hafner grew HASTA Capital into a $1 billion company. Today, he is expanding their multifamily operations abroad.

Mark’s fascination with where people live, and building something new, began early in life. Growing up in Rochester, New York, he would stare up at buildings and cranes from the car window and wonder: Who built those? And what were they for?

“Even today when I’m driving, my wife yells at me, ‘You’ll crash the car if you don’t stop looking at all those cranes,” he laughed.

Mark’s interest in construction and cranes led him to Harvard Business School to study business and real estate. He then moved to Charleston, South Carolina to work for a budding company called Greystar, now the largest operator of apartments in the U.S.

While at Greystar, Mark’s role expanded significantly, and he ultimately led the company’s international expansion into Europe and Latin America. He oversaw the investment and development of over 30,000 residential units and over $9 billion of multifamily rental properties and student housing.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: June 10, 2022| Lending / Finance, Marketing/PR

| Multifamily

| ALL

Walker & Dunlop’s Midwest Investment Sales Team presents One Arlington Apartments in Arlington Heights, Illinois. The highly amenitized 13-story structure offers 214 residential units across studio, one- and two-bedroom floor plans along with 15,800 square feet of ground floor retail space operating as a 25N Coworking facility.

A 5-minute drive to the Arlington Park Metra stop, the property is also next door to Arlington International Racecourse. The 326-acre parcel of land is currently under negotiation with the NFL’s Chicago Bears to be the site of a brand-new state-of-the-art stadium and entertainment complex.

With a median tenant household income of $102,000, strong property level lease trade-outs, and historically high projected submarket rent increases, One Arlington Apartments is well positioned to continue growth in Chicagoland’s highly desirable northwest suburbs.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: June 06, 2022| Commercial Properties for Sale

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| ILLINOIS

Walker & Dunlop’s property sales team is pleased to present Avondale Cottages, a luxury 40-home build-for-rent (“BFR”) community located adjacent to historic downtown Franklin, TN. This soon-to-be-completed community boasts the best location and highest finish qualities of any for-rent executive housing option in the Nashville MSA.

The property is in a walkable location and is embedded in the highly desirable Franklin submarket of Williamson County and benefits from exceptional schools, area amenities, and an extraordinarily high-quality community with a substantial corporate employment base a short drive from downtown Nashville, TN. With limited comparable options in the area, Avondale Cottages provides a luxurious rental alternative complete with custom home finishes in a charming neighborhood setting.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: May 31, 2022| Commercial Properties for Sale

| Multifamily

| TENNESSEE

WDIS California would like to invite you on a brief tour of Laurel Grove in Salinas, CA, which is currently listed by Walker & Dunlop.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: May 25, 2022| Commercial Properties for Sale

| Multifamily

| CALIFORNIA

During Walker & Dunlop’s 2022 Virtual Investor Day, members of senior management provide updates on Walker & Dunlop’s Drive to ’25 objectives, with a focus on new business areas, including Zelman, Apprise, Small Balance Lending, and Affordable Housing.

GET NOTIFIED about upcoming shows:

» Subscribe to our YouTube channel here:

/ @walkerdunlop

» See upcoming guests on the #WalkerWebcast here:

https://www.walkerdunlop.com/webcasts/

RELATED WEBCASTS: Tune in on Wednesdays for fresh perspectives about leadership, business, the economy, commercial real estate, and more! #WillyWalker hosts a diverse network of leaders as they share wisdom that cuts across industry lines. Guests include prominent CEOs, academics, high-ranking government officials, and sports heroes.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 18, 2023

| Date Created: May 20, 2022| Residential Properties for Lease, Residential Properties for Sale, Economics/Market Reports/Research, Lending / Finance, Technology / Proptech, Appraisal, Interviews / Speeches

| Residential, Multifamily

| ALL

Walker & Dunlop's Ohio-based property sales team is pleased to present Gateway Lofts Centerville, an exceptional institutional-sized, 360-unit fully tax-abated property. The property is in the preeminent submarket of Centerville, within suburban Dayton, between Cincinnati and Columbus, and will allow new owners to invest in a newly constructed suburban asset in a highly desirable location. Gateway Lofts Centerville offers superior asset quality and immediate outsized cash flow.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: April 26, 2022| Commercial Properties for Sale

| Multifamily

| OHIO

WDIS Ohio is pleased to present The Columbus 456 Portfolio, an exceptional three-property portfolio in the premier submarkets of Pataskala, Marysville, and Grove City. Located in some of Columbus's most fundamentally sound suburban locations, this portfolio presents a value-add buyer the chance to implement a thoughtful renovation program with no deferred maintenance.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: April 22, 2022| Commercial Properties for Sale

| Multifamily

| OHIO

WDIS California would like to invite you on a brief tour of Merritt on 3rd in Oakland, CA, which is currently listed by Walker & Dunlop.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: April 19, 2022| Commercial Properties for Sale

| Multifamily

| CALIFORNIA

Despite being a $20+ trillion industry, commercial real estate is behind the technology curve. The industry is ripe for disruption and needs innovation. At Walker & Dunlop our mission is to build the world’s best financing experience. We want our technology to make the user experience efficient and enjoyable. We’ve developed tools to provide a quote in minutes, automatically identify comps, and underwrite deals quickly. Watch our technology video to see how our team of data scientists and engineers are transforming the industry.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: April 13, 2022| Lending / Finance, Technology / Proptech, Marketing/PR

| ALL

| ALL

Walker & Dunlop's Philadelphia-based property sales team is pleased to present 1150 North American Street, a newly constructed, 74-unit apartment building located in the heart of Northern Liberties. This building includes both two- and four-bedroom units, an exceptional amenity package, and gated garage parking. With excellent curb appeal, the property also features a 4,000 square foot retail space currently leased to CKO Kickboxing. Located at the center of Northern Liberties, the property sits near nationally recognized restaurants and neighborhood amenities, which have resulted in local home price appreciation. 1150 North American Street will be a competitive asset in Philadelphia's high-performing residential market.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: April 12, 2022| Commercial Properties for Sale

| Multifamily, Mixed-Use: Multifamily / Retail

| PENNSYLVANIA

Now that we have officially settled into our new HQ in Bethesda, Maryland, we’d like to take you on a tour of the brand new space! Follow along as one of our employees walks us through the main lobby, shared workspaces, lounge area, tech-enabled conference rooms, and so much more.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: March 28, 2022| Lending / Finance, Tenant Concepts, Marketing/PR

| Office

| MARYLAND

WDIS South Florida is pleased to present First Apartments, a brand new 194 unit luxury mid-rise apartment community ideally situated in burgeoning East Little Havana. Completed in late 2021, the community received its TCO on September 1st, 2021 and has enjoyed extraordinary leasing velocity since opening. As of January 2022, the community reached 90% occupied and 95% leased, representing initial leasing velocity of nearly 45 leases per month. Even more impressive, lease rates have steadily increased with recent leases signed more than 25% above initial leases. This impressive performance is a testament to the appeal of the asset and its excellent location, proximate to key demand drivers, entertainment venues and transit routes.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: February 16, 2022| Commercial Properties for Sale

| Multifamily

| FLORIDA

Ivy Zelman, CEO and Co-founder of Zelman & Associates, and Cedric Bobo, CEO and Co-Founder of Project Destined, recently shared their best advice on kick-starting a commercial real estate and finance career! During this webcast, they also shared their thoughts on diversity in the CRE industry and beyond. Watch the clip above to hear their thoughts.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: February 09, 2022| Events / Webinars, Lending / Finance, ESG (Environmental, Social and Governance), Employment / Jobs

| ALL

| ALL

As leaders, how do we act as allies to our team members? How do we innovate through diverse teams? What is belonging…really? We tackled these questions and others in our leadership conference. “The Future is Us: Your Role in Creating a Culture of Belonging. During our time together, we explored allyship and belonging through conversations that helped to enable all participants to dig deep and show up as their authentic selves. Hear from our four external speakers including bestselling author Terri Trespicio.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: February 07, 2022| Events / Webinars, Lending / Finance, ESG (Environmental, Social and Governance)

| ALL

| ALL

NOVEL Midtown Tampa | 390 Residences Within Tampa's Newest Social Hub | Whole Foods-Anchored, Food & Beverage-Focused Walkable Community.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: February 03, 2022| Commercial Properties for Sale

| Multifamily, Mixed-Use: Multifamily / Retail

| FLORIDA

River House & Terra House | Rolling Mill Hill | Nashville, TN

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: January 21, 2022| Commercial Properties for Sale

| Multifamily

| TENNESSEE

WDIS South Florida is pleased to present Soleste Grand Central, a 360-unit luxury high rise investment opportunity located in booming downtown Miami. Situated just steps from Brightline’s MiamiCentral Station, this transit-oriented development (TOD) trophy asset first opened its doors in June of 2021.

Walker & Dunlop - Company and Property Videos | Date Uploaded: July 04, 2023

| Date Created: January 10, 2022| Commercial Properties for Sale

| Multifamily

| FLORIDA

The Build-for-Rent (BFR) market is booming! Watch our webcast highlighting the latest BFR trends, insights, and prediction for the future of the BFR space.

Our team of experts answer:

- What is #BFR exactly?

- Who's investing in the space (equity players), who's sitting on the sidelines (debt) and why?

- What do real-life financing scenarios look like?

- Why BFR may not be that different from multifamily

- What should your next steps be to ensure success in this booming market?

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Residential Properties for Lease, Events / Webinars, Lending / Finance

| Residential, Multifamily

| ALL

Walker & Dunlop: Annual Review 2020

2020 was a year like no other. Our 2020 Year in Review, featuring insights from our CEO, Willy Walker, and our CFO, Steve Theobald, showcases the highlights of our record year and provides a glimpse into our new five-year plan, the Drive to ’25:

• The power of our people, brand, and technology coming together to drive incredible value

• Record total revenues of $1.1 billion, up 33% YoY, and diluted EPS of $7.69, up 41% YoY

• 46% shareholder return in 2020 and 241% shareholder return over the past five years

• Successful closing out of Vision 2020

• Continued investments in recruiting and differentiating technology

• Focus on our Environmental, Social, and Governance (ESG) efforts

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Economics/Market Reports/Research, Events / Webinars, Lending / Finance, Technology / Proptech, ESG (Environmental, Social and Governance)

| ALL

| ALL

For Suzanne Hillman, leading a $5 billion company began with mastering the art of drywalling—and a distinctive approach to finding opportunities and realizing potential.

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Lending / Finance, REITs / Investment Funds, Marketing/PR

| Multifamily

| ALL

Sedona Slate represents an outstanding mixed-use investment opportunity in the heart of Arlington, VA. Consisting of 474 units across two LEED Gold Certified Class A towers, Sedona Slate is one of the most well-designed, visually appealing communities in the Washington, DC area. Developed in 2013 by JBG Smith, Sedona Slate offers the opportunity to acquire a stabilized asset in a thriving submarket well below replacement costs.

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Commercial Properties for Sale

| Multifamily, Mixed-Use: Multifamily / Retail

| VIRGINA

What is Walker & Dunlop's corporate vision for the next 5 years and how do we plan to get there? Our 2020 Investor Day, held for analysts and investors, includes an overview of our strategy with presentations by our senior management team. Hosted by our CEO Willy Walker, our CFO Steve Theobald, and more.

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Economics/Market Reports/Research, Events / Webinars, Lending / Finance, ESG (Environmental, Social and Governance)

| ALL

| ALL

On August 18, 2020, Walker & Dunlop’s Ted Patch and Blake Lanford, and Chatham’s Matt Hoffman combined forces for a webcast on the LIBOR to SOFR transition. The discussed the timing for the shift, the fate of floating rate, how the Agencies are handling the transition, and the implications for both existing and new loans. #CRE #CREFinance #LIBOR #SOFR #Webcast #FannieMae #FreddieMac

Walker & Dunlop - Company and Property Videos | Date Uploaded: April 05, 2021

| Date Created: | Economics/Market Reports/Research, Government, Lending / Finance

| ALL

| ALL