VIDEO SEARCH

2254 videos found

Dave Codrea, CEO with Greenleaf Capital Partners, joins Bull Realty CEO Michael Bull to discuss strategies and risks in various asset classes in this point in the cycle.

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: August 22, 2023| Commercial Properties for Sale, Economics/Market Reports/Research, Property Services/Inspections, REITs / Investment Funds, Interviews / Speeches

| Industrial, Multifamily, Office, Retail, ALL

| ALL

204 acres of development land at 592 Catawba Lane, Blountville, TN 37617 available for purchase. For more info, contact: Austin Heithcock

Senior Advisor

615.477.1977

h.austin@capstone-companies.com

Adam Klenk

Partner

615.861.9906

adam@capstone-companies.com

Jordan Arand

Investment Sales Advisor

815.291.9250

jarand@capstone-companies.com

Blake Wiser

Investment Sales Advisor

731.234.2388

bwiser@capstone-companies.com

Josh White

Investment Sales Advisor

334.703.2492

jwhite@capstone-companies.com

VidTech | Date Uploaded: December 30, 2023

| Date Created: November 01, 2023| Commercial Properties for Sale, Brokerage, Development/Planning/Entitlements

| Land

| TENNESSEE

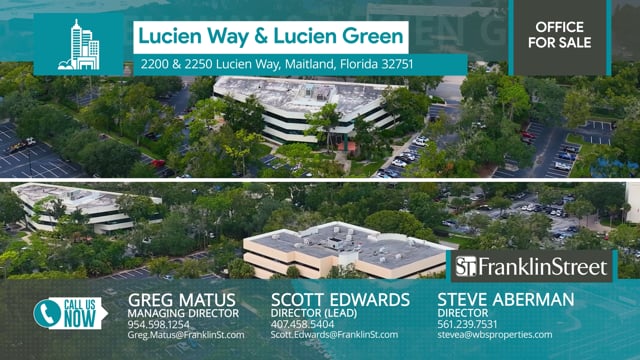

Two office buildings in Orange County, FL listed for sale -- 2200 Lucien Way & 2250 Lucien Way, Maitland, Florida 32751

Franklin Street:

Scott Edwards | Director | 407.458.5404 | Scott.Edwards@FranklinSt.com

Greg Matus | Managing Director | 954.671.1821 | Greg.Matus@FranklinSt.com

Steve Aberman | Director | 561.239.7531 | stevea@wbsproperties.com

VidTech | Date Uploaded: December 30, 2023

| Date Created: November 01, 2023| Commercial Properties for Sale, Brokerage

| Office

| FLORIDA

Greg Friedman with Peachtree Hotel Group joins host Michael Bull to discuss the hotel and hospitality sector, including post-pandemic performance, lender sentiment, future opportunities.

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: August 10, 2023| Development/Planning/Entitlements, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Hospitality

| ALL

Join show host Michael Bull as he interviews Xander Snyder, Senior Economist with title company First American. Discussions include expectations for hard vs soft lending, bank outlook, repair and maintenance cost, and areas of opportunities for investors, occupiers, and lenders.

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: August 04, 2023| Economics/Market Reports/Research, Lending / Finance, Property Management, Interviews / Speeches

| ALL

| ALL

Eliza Bailey, CEO with Belay Investment Group, joins commercial broker Michael Bull to share insight for sponsors and developers to attract and choose the right equity partners. Plus, tips and strategies for equity groups to choose the most successful operating partners and projects.'

C5+CCIM Global Summit - 3 Days of Commercial Real Estate Networking, Learning, & Investing in Atlanta, Georgia, September 28-30th! : https://c5summit.realestate/

Brought to you by:

Bull Realty - Customized Asset & Occupancy Solutions: https://www.bullrealty.com/

Commercial Agent Success Strategies - The ultimate commercial broker training resource: https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: July 31, 2023| Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds, Interviews / Speeches

| ALL

| ALL

Tim Bodner, Global Real Estate Deals Leader with PwC joins commercial broker Michael Bull to discuss PwC’s mid-year commercial real estate outlook. Discussions include the major sectors, niche sectors, lenders, and equity.

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: July 21, 2023| Commercial Properties for Lease, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Tom LaSalvia, Head of Commercial Real Estate with Moody's Analytics, discusses the state of commercial real estate, performance, transaction volume, financing, and expectations moving forward.

C5+CCIM Global Summit - 3 Days of Commercial Real Estate Networking, Learning, & Investing in Atlanta, Georgia, September 28-30th! : https://c5summit.realestate/

Brought to you by:

Bull Realty - Customized Asset & Occupancy Solutions: https://www.bullrealty.com/

Commercial Agent Success Strategies - The ultimate commercial broker training resource: https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: July 13, 2023| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Industrial, Multifamily, Office, Retail, ALL

| ALL

Carl Whitaker, Director of Research and Analysis with RealPage, joins Bull Realty CEO and show host Michael Bull to discuss the evolving landscape of student housing. They delve into the performance of student housing properties, rent increases, factors influencing student enrollment, and the emergence of new supply in certain markets. Discover the current state of the student housing sector, the impact of changing economies, and potential opportunities for investors and operators in this dynamic market.

https://www.realpage.com/

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: May 19, 2023| Residential Properties for Lease, Development/Planning/Entitlements, Economics/Market Reports/Research, Interviews / Speeches

| Multifamily, Student Housing

| ALL

Join host Michael Bull as he engages in a captivating conversation with Caitlin Walter, the Vice President of Research at the National Multifamily Housing Council (NMHC). In this must-watch video, they provide expert analysis on the current state of the real estate market, covering essential topics such as rent growth, vacancy rates, supply and demand dynamics, and the transformative potential of office spaces. Gain valuable insights into the effects of remote work on central business districts, the urgent need for increased housing supply across various segments, and the challenges faced in developing workforce housing. Delve into the rising trend of adaptive reuse, where office, hotel, and retail spaces are converted into residential units, and explore its potential in tackling the affordability crisis. Furthermore, Michael and Caitlin discuss market concerns including economic uncertainties, cost escalations, regulatory impacts, and the influence of climate-related factors on insurance and investment decisions. Stay ahead of the curve with these industry experts as they navigate the complexities of the real estate landscape.

https://www.nmhc.org/

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: May 11, 2023| Commercial Properties for Lease, Residential Properties for Lease, Economics/Market Reports/Research, Property Management, Trade Groups, Interviews / Speeches

| Multifamily, Office

| ALL

Host and Bull Realty CEO Michael Bull discusses the current state of the industrial real estate market with Neil Moskowitz, Senior VP and Principal at Stone Mount Financial Group. They explore the impact of factors such as the Federal Reserve's rate hikes and changing demand dynamics on industrial properties. Discover the latest trends in leasing, rental rates, and construction costs, as well as insights into building design and investor preferences. Gain valuable insights into the challenges faced by developers and investors in the industrial sector, including the availability of financing. Don't miss this informative discussion that sheds light on the opportunities and obstacles in the thriving industrial real estate market.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: May 01, 2023| Development/Planning/Entitlements, Economics/Market Reports/Research, REITs / Investment Funds, Interviews / Speeches

| Industrial

| ALL

Ermengarde Jabir with Moody's Analytics joins host Michael Bull to dive into the dynamics of the single family home rental market, its impact on the apartment market, and the evolving trends in homeownership. They explore the performance of institutional owners, rental growth, tenant profiles, and the relationship between single family rentals and apartment rentals. The conversation also touches upon the appreciation of single family homes, affordability challenges, supply constraints, and the future outlook for the market. Gain valuable insights into the current state and future prospects of the single family home rental market.

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: April 21, 2023| Residential Properties for Lease, Economics/Market Reports/Research, Property Services/Inspections, Interviews / Speeches

| Multifamily

| ALL

Gunnar Branson (CEO of AFIRE), joins Michael Bull (CEO of commercial brokerage firm Bull Realty) to discuss takeaways from the 2023 Q1 AFIRE International Investor Survey.

Read the AFIRE Survey:

https://www.afire.org/survey/q12023pu...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: April 13, 2023| Economics/Market Reports/Research, REITs / Investment Funds, ESG (Environmental, Social and Governance), Interviews / Speeches

| ALL

| ALL

Chris Marinac with Janney Montgomerey Scott joins Michael Bull in Studio One to discuss the outlook for US banks and its effect on commercial real estate. Chris leads the Bank Research Team at Janney, so get ready for some inside knowledge!

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 30, 2023

| Date Created: April 29, 2023| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Our mission is to create communities — with ideas and capital — where people live, work, shop, and play.

Learn more at: https://www.walkerdunlop.com/

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 12, 2023| Lending / Finance, Marketing/PR

| Multifamily, ALL

| ALL

Walker & Dunlop launched CREUnited in 2021 to address a systemic lack of diversity in commercial real estate. CREUnited is an alliance of leading CRE firms dedicated to increasing minority participation across the entire commercial real estate industry, with the overarching goal of growing assets under management by underrepresented groups.

Reach out to us at CREUnited@walkerdunlop.com to get more information and to set up a time to talk, or visit our website at https://www.walkerdunlop.com/what-mak... to learn more.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 12, 2023| Lending / Finance, ESG (Environmental, Social and Governance), Employment / Jobs

| ALL

| ALL

Walker & Dunlop is pleased to announce the offering of Eastpointe Lakes: a 1998 built, 252-unit, suburban garden style apartment complex located in Blacklick within the Silicon Heartland corridor.

Walker & Dunlop - Company and Property Videos | Date Uploaded: December 25, 2023

| Date Created: June 05, 2023| Commercial Properties for Sale

| Multifamily

| OHIO

Forward-thinking leaders are seeking answers to their boardroom challenges, and real estate might just hold the key. Discover how innovative solutions in real estate can address sustainability, talent retention, and more. Explore brighter ideas, and think real estate.

JLL TV | Date Uploaded: December 25, 2023

| Date Created: December 17, 2023| Brokerage, Property Management, Technology / Proptech, ESG (Environmental, Social and Governance), Marketing/PR, Employment / Jobs

| ALL

| ALL

Dan Wagner joins Michael Bull to discuss the President’s tax plan. Discussions include how the plan could impact the economy, commercial real estate, and banks. Plus links to learn more and easily share your thoughts with Congress.

1031 Policy Resources:

https://take-action.ipx1031.com/ctas/...

https://1031buildsamerica.org/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: April 07, 2023| Economics/Market Reports/Research, Government, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Mat Sorensen, CEO of Directed IRA, and author of The Self-Directed IRA Handbook joins commercial broker Michael Bull to discuss the tax savings, process, cost, and guidelines for sponsors raising money, and investors to utilize self-directed IRAs to invest in real estate. Sponsors tap some of the $35 trillion in retirement accounts! Investors save tax dollars and diversify!

https://matsorensen.com/

https://directedira.com/

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: April 05, 2023| Lending / Finance, Tax Services/Accounting, REITs / Investment Funds, Interviews / Speeches

| ALL

| ALL

Hear takeaways from the 8th annual sentiment survey featuring results from 2,500 commercial real estate professionals, including investors, asset managers, lenders, private equity, and more.

Read the 2023 Real Estate Sentiment Survey: https://www.seyfarth.com/real-estate-...

00:00 - Intro

02:38 - Key Takeaways

06:10 - Interest Rates

07:33 - Recession Concerns

09:58 - Recession Length Projections

14:43 - Top Industry Concerns

15:37 - Sector Opportunities

20:29 - Will Investment Sites Shift to Suburban?

21:35 - Effects of Hybrid/WFH

23:25 - Office Space Usage

24:39 - Policy and Real Estate

26:10 - Policy and Corporate Office Relocation

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: March 23, 2023| Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds, Interviews / Speeches

| Office, ALL

| ALL

John Boyd with the Boyd Company joins Michael Bull to discuss the top markets for corporate relocation and new manufacturing in our post-pandemic environment.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: March 17, 2023| Economics/Market Reports/Research, Tenant Concepts, Interviews / Speeches

| Industrial, Office

| ALL

The big question for retail in 2023 - will post-COVID "revenge spending" continue to fuel high sales, or are inflation and higher interest rates slowing consumers down?Jim Costello, Chief Economist with MSCI - Real Estate, joins Michael Bull to look at retail performance and how it's affecting sales volume and cap rate trends for the U.S. sector.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: March 10, 2023| Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Retail

| CALIFORNIA

Phil Mobley, National Director of Office Analytics with CoStar Group, sits down with Michael Bull to discuss the U.S. office market. Discussions include vacancies, rental and absorption rates, and leasing and sales volume.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: March 03, 2023| Commercial Properties for Lease, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Office

| ALL

Carl Whitaker with RealPageAnalytics joins Michael Bull to share market performance, strategies, and forecasts for U.S. apartments and multifamily properties. Discussions include rent and occupancy updates, new supply levels vs corresponding demand, and opportunities in 2023.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: February 24, 2023| Commercial Properties for Sale, Residential Properties for Lease, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Multifamily

| ALL

Lamar H. Ellis, President of Drone Education Services and FAAST (Federal Aviation Administration Safety Team) DronePro Representative, joins Michael Bull in Studio One to discuss drone uses in commercial real estate, including marketing, inspections, and appraisals, and how to stay compliant with the Federal Aviation Administration through a Part 107 Exemption.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: February 16, 2023| Drone/Artistic, Legal, Property Services/Inspections, Technology / Proptech, Appraisal, Marketing/PR, Interviews / Speeches

| ALL

| ALL

Demand for office is returning in many markets, but some property owners are looking for alternative returns by converting to multifamily. Meanwhile, housing developers are seeing big savings with conversions vs original builds.

John Cetra, Founding Principal of architectural firm CetraRuddy, joins Michael Bull to discuss the challenges - and opportunities - involved in this growing adaptive reuse trend.

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: February 09, 2023| Commercial Properties for Lease, Residential Properties for Lease, Architecture, Construction, Development/Planning/Entitlements, Government, Interviews / Speeches

| Multifamily, Office

| ALL

Nancy Miller, head of Bull Realty's Single Tenant Net Lease Investment Group, joins Michael Bull to share insight on current cap rates for STNL properties. Discussions include current financing rates, loan-to-value ratios, and tenant trends.

00:00 - Intro

01:50 - Cap Rates

03:05 - Financing

05:12 - STNL Stability

06:05 - Inventory

07:24 - Tenant Trends

09:35 - Interest Rates

10:00 - Sourcing Properties

11:07 - Tips for Sellers

11:58 - Tips for Buyers

14:18 - Final Thoughts

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: February 02, 2023| Brokerage, Economics/Market Reports/Research, Lending / Finance, Tenant Concepts, Interviews / Speeches

| Retail

| ALL

Lonnie Hendry with Trepp joins Michael Bull to share the current status of troubled loans and expectations moving forward. Discussions include advice for borrowers facing looming loan maturities, and investors looking for opportunities.

Check out the Trepp Wire Podcast at https://www.trepp.com/the-treppwire-p...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: January 25, 2023| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Multifamily, Office, Retail, ALL

| ALL

Jamie Woodwell joins Michael Bull to share highlights from the newly released Mortgage Bankers Association's CREF Outlook Survey on expectations of the most active commercial and multifamily lenders. Discussions include rates, volumes, and the most active lenders' views on the market.

Read the survey here: https://newslink.mba.org/cmf-newslink...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: January 20, 2023| Economics/Market Reports/Research, Lending / Finance, Trade Groups, Interviews / Speeches

| Multifamily, ALL

| ALL

Ed Pierzak with Nareit joins Michael Bull to discuss key takeaways from the annual outlook report.

Read Nareit's outlook here: https://www.reit.com/sites/default/fi...

00:00 - Intro

01:02 - Recession Risk

04:13 - Interest Rates

07:12 - Inflation

08:18 - Inflation & REITs

09:05 - Office Sector

09:49 - Historic REIT Performance

13:28 - REITs vs Private Real Estate

16:32 - REITs & Acquisitions

17:49 - Final Thoughts

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: January 12, 2023| Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds, Trade Groups, Interviews / Speeches

| Office, ALL

| ALL

A look into expected performance and transaction volume via Tim Bodner, PwC's U.S. Real Estate Deals Leader.

PwC's 2023 Real Estate Deals Outlook: https://www.pwc.com/us/en/industries/...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 25, 2023

| Date Created: January 09, 2023| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Hospitality, Industrial, Residential, Multifamily, Retail, Other, ALL

| ALL

Michael Bull shares sources for the top five of skills to hone for success in business development, sales, and commercial brokerage.

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

#commercialrealestate #commercialrealestatecoaching #sales

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: December 31, 2022| Brokerage, Educational Programs, Interviews / Speeches

| ALL

| ALL

Mark Mathews with the National Retail Federation joins show host Michael Bull to discuss how retailers are faring and expectations moving forward. Discussions include holiday sales forecast, online vs in-store sales, and categories expected to do well.

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

#commercialrealestate #retail #nrf

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: December 14, 2022| Economics/Market Reports/Research, Tenant Concepts, Interviews / Speeches

| Retail

| ALL

Tom Walsh joins Michael Bull on America’s Commercial Real Estate Show to share an inside look at the current state of financing including interest rates, LTV, DCR, underwriting, valuations, and sources. Discussions include an update on the appetite of the various financing sources including Fannie, Freddie, HUD, CMBS, Life Co and Banks. They also cover strategies related to loan maturities, workouts, distress and how this market may shake out compared to previous cycles.

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: December 02, 2022| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Mitch Roschelle with Macro Trend Advisors joins Michael Bull to discuss the current and future economic market and its effect on commercial real estate, including rising interest rates, cap rate trends, and potential opportunities.

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: November 29, 2022| Economics/Market Reports/Research, Government, Lending / Finance, Interviews / Speeches

| Hospitality, Industrial, Office, ALL

| ALL

The Red Shoe Economist joins Michael Bull in Studio One to discuss expectations for interest rates, pricing discovery, and opportunities in the current market.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: November 23, 2022| Commercial Properties for Sale, Economics/Market Reports/Research, Government, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Tim Bodner and Byron Carlock with PwC join Michael Bull in Studio One to cover highlights and takeaways from the 44th edition of Emerging Trends.

Download the report here: https://www.pwc.com/us/en/industries/...

Part 1:

• PwC / ULI 2023 Emerging Trends in Rea...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: November 23, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance

| ALL

| ALL

Tim Bodner and Byron Carlock with PwC join Michael Bull in Studio One to cover highlights and takeaways from the 44th edition of Emerging Trends.

Part 2:

• PwC / ULI 2023 Emerging Trends in Rea...

Download the report here: https://www.pwc.com/us/en/industries/...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: November 11, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research, Interviews / Speeches

| ALL

| ALL

CoStar's National Director of Office Analytics Phil Mobley joins Michael Bull to discuss the U.S. office market. Discussions include current and forecasted occupancy rates, rental rates, loan rates, cap rates and demand.

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: November 04, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Office

| ALL

Brian Bailey, Federal Reserve Real Estate Subject Matter Expert joins show host Michael Bull in Studio One to share his view on the commercial real estate market.

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: October 19, 2022| Economics/Market Reports/Research, Government, Lending / Finance, Employment / Jobs, Interviews / Speeches

| Office, ALL

| ALL

Awesome show covering highlights and takeaways from Deloitte's annual outlook survey of Real Estate CFO's. John D'Angelo, U.S. Real Estate Solutions Leader joins show host Michael Bull to help us plan for 2023.

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: October 16, 2022| Economics/Market Reports/Research, Lending / Finance, Technology / Proptech, ESG (Environmental, Social and Governance), Interviews / Speeches

| Industrial, Office, Retail, ALL

| ALL

Thomas LaSalvia, Senior Economist with Moody's Analytics, joins Michael Bull to discuss the latest performance and cap rates for retail properties, including a forecast and strategies for current markets.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: October 05, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance, Tenant Concepts, Interviews / Speeches

| Retail

| ALL

Carl Whitaker with RealPage joins show host Michael Bull to share recent performance variances and projections for performance and cap rates moving forward.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: September 30, 2022| Commercial Properties for Sale, Residential Properties for Lease, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Multifamily

| ALL

Marco Welch, VP with the Apartment Group at Bull Realty, joins Michael in Studio One to discuss how interest rates have impacted the multifamily market, current cap rates, and investor trends for the sector.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: September 15, 2022| Commercial Properties for Sale, Residential Properties for Lease, Brokerage, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| Multifamily

| GEORGIA

Tom O'Hern, CEO and Director of Macerich, one of the largest retail REITs in the world with 48 million square feet of property, joins Michael to discuss how large retail properties have performed, leasing activity, and mall property conversions.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: September 13, 2022| Commercial Properties for Lease, Development/Planning/Entitlements, Property Management, Tenant Concepts, REITs / Investment Funds, Interviews / Speeches

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| ALL

Joseph Coradino with PREIT (Pennsylvania Real Estate Investment Trust), a large owner of U.S. malls, discusses the state of malls with show host Michael Bull. Discussions include performance, occupancy, emerging tenants, and the future of American Malls.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: September 09, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Development/Planning/Entitlements, Economics/Market Reports/Research, Property Management, Tenant Concepts, REITs / Investment Funds, Interviews / Speeches

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| ALL

Paul Zeman with Healthcare Real Estate Services of Bull Realty shares insight on U.S. medical office performance, sales volume, cap rates, plus some strategies working for investors, physician groups, and developers.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: August 29, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Development/Planning/Entitlements, Economics/Market Reports/Research, Lending / Finance, Tenant Concepts, Interviews / Speeches

| Medical, Office

| ALL

Dr. Matt Trowbridge with the International WELL Building Institute joins host Michael Bull to discuss strategies for making built space healthier and attracting talent back to the office, benefits of the WELL process, and future trends in office wellness.

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: August 24, 2022| Interior Design, Property Management, ESG (Environmental, Social and Governance), Interviews / Speeches

| Office

| CALIFORNIA

Clark Kendall, CEO of Kendall Capital, joins host Michael Bull to provide some perspective on the current market and strategies for investors.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: December 24, 2023

| Date Created: August 18, 2022| Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds, Interviews / Speeches

| ALL

| ALL