VIDEO SEARCH

2421 videos found

7200 N University Drive - Tamarac, FL

33321 - United States

---

Bastian Laggerbauer

+1 561 281 6656

bastian.laggerbauer@colliers.com

Brooke Berkowitz

+1 954 652 4633

brooke.berkowitz@colliers.com

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Sale

| Land, Medical, Multifamily, Retail

| FLORIDA

Office space for Lease at Miramar Park of Commerce

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Office

| FLORIDA

6975 Golfcrest Drive, San Diego, CA 92119

J. Kevin Mulhern

Senior Vice President

+1 858 646 4723

kevin.mulhern@cbre.com

Lic 00804871

Stewart I. Weston

Executive Vice President

+1 949 725 8416

stew.weston@cbre.com

Lic 01108354

Dean Zander

Executive Vice President

+1 310 550 2599

dean.zander@cbre.com

Lic 00875853

John Montakab

First Vice President

+1 949 725 8648

john.montakab@cbre.com

Lic 01837657

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

3443 North Central Avenue, Phoenix, Arizona, 85012, United States

Ironline Partners

ironlinepartners.com

Tim O'Neil, Principal

602.315.8275

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Land, Office, Retail, Mixed-Use: Office / Retail

| ARIZONA

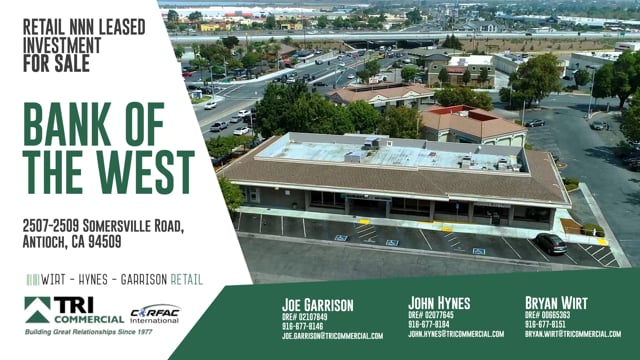

Bank of the West

2507-2509 Somersville Road

Antioch, CA 94509

For Sale

John Hynes

DRE: 02077645

Tel: 916.677.8184

john.hynes@tricommercial.com

Bryan Wirt

DRE: 00665363

Tel: 916.677.8151

bryan.wirt@tricommercial.com

Joe Garrison

DRE: 02107849

Tel: 916.677.8146

joe.garrison@tricommercial.com

VidTech1 | Date Uploaded: October 22, 2020

| Date Created: | Commercial Properties for Sale

| Retail

| CALIFORNIA

For Leasing Information Please Contact:

Michele Dawson

FFO Realty

410.970.6671

mdawson@fforealty.com

Scott Ferguson

FFO Realty

610.658.6310

sferguson@fforealty.com

VidTech1 | Date Uploaded: October 22, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| NEW YORK

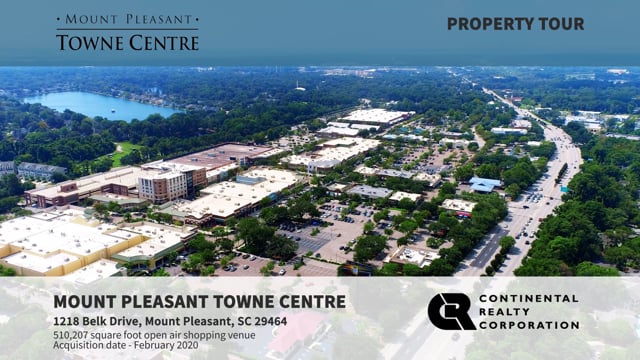

1218 Belk Dr., Mt. Pleasant SC

VidTech1 | Date Uploaded: October 22, 2020

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale

| Retail

| SOUTH CAROLINA

370-390 Amapola Avenue, Torrance, California

For More Details On What's Available, Please Visit:

loopnet.com/Listing/370-Amapola-Ave-Torrance-CA/9527523/

Max Robles: (562)354-2531

Garrett Massaro: (562)354-2516

Brandon Carrillo: (562)354-5100

Lee & Associates: Brandon Carrillo | Date Uploaded: October 21, 2020

| Date Created: | Commercial Properties for Lease

| Office

| CALIFORNIA

17101 S Central Ave, Carson, CA

7,000 SF of Industrial Space Available in Carson, CA

To Find Out More, Please Visit:

loopnet.com/Listing/17101-S-Central-Ave-Carson-CA/16274459/

Max Robles (562)354-2531

Garrett Massaro (562)354-2516

Brandon Carrillo (562)354-2510

Lee & Associates: Brandon Carrillo | Date Uploaded: October 21, 2020

| Date Created: | Commercial Properties for Lease

| Industrial

| CALIFORNIA

I had a very pleasant conversation with my guest today, Jacob Blackett, who is founder of SyndicationPro before we recorded today's episode. And what I discovered is how he helps his developer clients tap into that subconscious marketing response: FOMO - The Fear of Missing Out. FOMO is one of the primary triggers that drives consumer action and that, of course, also applies to investor intent.

Now there are two things going on with FOMO. First, there’s the natural desire to want something that everyone else has. And second, there’s a sense that unless we act quickly, something is going away. So, to effectuate FOMO and raise more real estate money, you have to show that other people are investing and that the window of opportunity to invest is going to close.

Jacob Blackett's company, SyndicationPro is a back-end investor management system, similar to CrowdStreet Connect, IMS, Juniper Square, etc. But SyndicationPro has built into their platform a killer FOMO function: the investment reservation option for when a sponsor is in-between deals. It's really cool and is not dissimilar to the waitlist system that Origin Investments famously used to raise 105 million in 17 hours.

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Events / Webinars, Lending / Finance

| ALL

| ALL

From this video:

Brandon Sedloff: There's a lot of different ways to describe an investor portal and it can get very confusing but our definition of investor portal is really clear. It's a place where you can go to securely access information about your investment. So, oftentimes, you know, many groups, if they're just getting started, they don't even have an investor portal. You ask them how they communicate with their investors? They say, we send emails. Well, we all know that emails are not really the most secure way to send highly confidential information and there's lots of limitations in terms of what you can share, how you can share it, etc. And so, the industry is moving to secure cloud-based portals and the portal.. the most important thing to think about a portal, is you can go license Dropbox or Box.com and that's a great place to stick documents, right, many use Google Drive, etc.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Events / Webinars, Lending / Finance, Technology / Proptech

| ALL

| ALL

From this video:

Brandon Sedloff: We have customers that have over 5000 investor positions or more. And so, you know, the way to think about it is, really twofold. Investment managers have a decision. You can get away with using spreadsheets to a certain level but typically what we find is that the market today, the investors, are demanding more transparency, more accessibility, and investor portals are becoming the norm. And so, we actually see a lot of smaller managers starting to adopt this category of software and adopt Juniper Square well before they have the real need from a friction perspective. So, you know, I would say if you've got 10 or more investors, you would get significant benefit out of a software like Juniper Square.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Events / Webinars, Lending / Finance, Technology / Proptech

| ALL

| ALL

From this video:

Brandon Sedloff: Juniper Square is an All-In-One investment management software that was built to streamline fundraising and ultimately help improve the timeliness and the accuracy of investor reporting and that enables investors and managers to have real-time access to data to help investment managers scale their business. There's a few different components to our software as you think about, kind of, what the scope of this is. There's a CRM or client relationship management tool to help investment managers better manage capital relationships. There's tools that help automate parts of the fundraising process that obviously helps investment managers to raise more capital with less work, something I know you know a lot about.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Events / Webinars, Lending / Finance, Technology / Proptech

| ALL

| ALL

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

The Juniper Square platform manages over one trillion dollars. Yes, you read that correctly. Today, you're going to be hearing from Brandon Sedloff, Juniper Square's Vice President of Sales and Managing Director.

As you probably know, here at GowerCrowd, we build digital marketing platforms for real estate sponsors who want to raise money online. But what we don't do is handle the money once a prospect has converted to being an investor. That is the realm of companies like Juniper Square. Now, there are two phases to raising real estate capital. The first phase is in finding prospects and nurturing them so that they become active investors. It is driven by content marketing, education and implementation of proven digital marketing systems like auto-responding emails, auto-posting social media and, at its core, massive content production with the minimum of effort.

Now, once someone invests, they move into phase two. What we do is largely educational. What Juniper Square does, in phase two, is to securely store legal documents, calculate distributions to investors, provide investors with an investment dashboard so they can see how their investments are performing, and more.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Events / Webinars, Lending / Finance, Technology / Proptech

| ALL

| ALL

From this video:

Jay Olshonsky: I certainly think, you know, if you go back to product type. If you go back to product type that, I can tell you, there's all kinds of people that are raising funds for hospitality and hotel. So, I think anyone that has any expertise in crowdfunding, either with a hotel, teaming up with hotel buyers, or things like that, I think that's an area. I also do think there will be some aspects of multifamily and I know there's been crowdfunding in multifamily, from the point of view, just because ultimately, look, this will correct.

How will real estate crowdfunding be impacted by the current downturn? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Sale, Brokerage, Events / Webinars, Lending / Finance

| Hospitality, Industrial, Multifamily, Office, Retail, ALL

| ALL

From this video:

Jay Olshonsky: We have some of our member firms have already gotten receivership opportunities, which is the beginning of the foreclosure. We also have some of our hotel receiver companies within NAI already seeing some hotels that they want to be received and that is the beginning or the baby steps towards the foreclosure because you have to have receivership. You have to have management. You have to have leasing and then ultimately sale at the property level.

What can the sixth largest brokerage firm in the world teach you about real estate? Watch this to find out.

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Hospitality, Industrial, Multifamily, Office, Retail, ALL

| ALL

From this video:

Jay Olshonsky: It is interesting. Let's talk about it for a second, because it dramatically changes the makeup of a mall. Right? Instead of walking into a department store, now you've got a boarded-up thing with a distribution center behind it. When I was building movie theaters, it was a condition of our lease that certain tenants stayed in place. In fact, actually, people made it a condition of their lease that we stayed in business. So it's a fundamental shift and this is important actually. It's a fundamental shift in the way that we will recover from this downturn, is that certain asset classes are going to fundamentally change. Right. Hospitality, even offices and we've talked about that. Instead of densification, inside the office, more and more people packed into smaller areas that people will spread out to even inside offices because they need more social distancing, etc. How do you think overall, that's going to impact, retail for example.

How will the downturn impact different asset classes? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: October 15, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Industrial, Office, Retail

| ALL

Up to 17,156 Office space available for lease in Prospect Lefferts Garden!

2nd floor: 5,018 RSF

3rd Floor: 5,179 RSF

4th Floor: 3,482 RSF

5th Floor: 3,477 RSF

6th floor: shared roof top with elevator access.

Highlights:

-Prime for medical and office

-Lobby

-Elevator

-Roof deck

-Parking on premises

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Office

| NEW YORK

Tri State Commercial Realty LLC

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Brokerage

| Office, Retail

| NEW YORK

Up to 12,087 SF Prime Community Facility Space Available! :

- At the base of brand-new 65-unit luxury condominium

- Zoning Use "Group 3": School with 200 Children Age 2-6 Year Old And 30 Teachers (Please see the Certificate of Occupancy in the brochure or on the website)

- Modern Spacious Lobby w/ Doorman & Seating Area

- Divisible

- Elevator

- Vanilla Box Condition

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Other, Education

| NEW YORK

2,000 - 17,800 Office | Medical Space for Lease in Sheepsheadbay!

Highlights:

-10 Exam Rooms

-2 Restrooms (patient/staff)

-Prep Stations

-Large waiting area

-Large reception area

-Procedure Room

-2 consulting rooms

-Immediate Possession

-Entire Building may be available (Possession for entire building will be arranged)

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Medical, Office

| NEW YORK

3,400 SF 3rd Floor Office Space for Lease in Williamsburg!

Highlights:

-New Windows

-Kitchen Space

-AC Units

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Office

| NEW YORK

More info: http://tristatecr.com/inventory?prope...

1,150 SF -3,450 SF Retail | Office in East Williamsburg

Highlights:

-Duplex Layout

-Finished Basement

-Move in Ready

3D tour: https://my.matterport.com/show/?m=pvK...

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Office, Retail

| NEW YORK

Highlights:

-Newly Renovated

-Modern Lobby

-HVAC

-Wraparound windows

-2 bathrooms

-Outdoor Area

3D tour: https://my.matterport.com/show/?m=ixD...

99 Walworth St, Brooklyn, NY 11205

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| NEW YORK

Up to 2,900 SF Retail | Office Space for Lease in Bushwick

Highlights:

-White box

-Split Units

-Outdoor space

3D tour - https://my.matterport.com/show/?m=Gj9...

651 Bushwick Ave, Brooklyn, NY 11221

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Office, Retail

| NEW YORK

+ 3,500 SF

+ Medical Buildout, but Suitable for any business

+ Move In Ready

+ 18 Rooms

+ Waiting Area

+ 2 Bathrooms

Tri State Commercial Realty | Date Uploaded: October 15, 2020

| Date Created: | Commercial Properties for Lease

| Medical, Office

| NEW YORK

Mills Shopping Center

10301 - 10395 Folsom Blvd

Rancho Cordova, CA 95670

For Lease

Ryan Orn

Joe Blanton

Capital Rivers Commercial | Date Uploaded: October 14, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| CALIFORNIA

COVID-19's effect on the US economy is creating widespread disruptions across all markets. While the Commercial Real Estate sector is slow to reflect economic changes, there will be significant differences come 2021.

Watch as I discuss the future of the office landscape with WeWork SoCal Portfolio Director, Matt Osborn.

We dive into the office landscape as well as the many challenges and opportunities faced by OC's tech-startup community.

Aspect Real Estate Partners | Date Uploaded: October 09, 2020

| Date Created: | Economics/Market Reports/Research, Events / Webinars

| Office

| CALIFORNIA

What Multifamily Commercial Real Estate Owners Should Know During the Pandemic

By far, most owners of income-producing real estate own rental homes or condos, and many manage the properties themselves. What should they know during the pandemic about the housing rental market and what should they do if their tenant(s) are struggling to pay rent? Learn this and more in Aspect's recent webinar.

For office and retail commercial real estate insights, leasing, and consulting, please contact us.

Aspect Real Estate Partners | Date Uploaded: October 09, 2020

| Date Created: | Residential Properties for Lease, Brokerage, Economics/Market Reports/Research, Events / Webinars, Property Management

| Multifamily

| CALIFORNIA

Learn how to rebuild your business after COVID_19

The goal of this webinar is to provide you with detailed guidance, resources, and contacts within the community while you survive, adapt, and thrive.

Through Aspect's close relationship with the Irvine Chamber of Commerce, we devised resources and strategies to help businesses like yours reopen, manage and mitigate disruptions caused by the COVID-19 crisis.

The continued success of Orange County’s small business community has always been our utmost priority. It's what we specialize in as commercial real estate brokers in Orange County.

For office and retail commercial real estate insights, leasing, and consulting, please contact us.

Aspect Real Estate Partners | Date Uploaded: October 09, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Office, Retail

| CALIFORNIA

In this webinar, the Aspect Team, the City of Santa Ana, and the Santa Ana Chamber of Commerce present a recovery plan for businesses along with links and resources available to all businesses in Orange County.

A must-watch for all office and retail businesses.

The panel of experts include:

Kristine Ridge, City Manager, Santa Ana

Dave Elliot, CEO, and President, Santa Ana Chamber of Commerce

Fred Delariva, Business Development Manager, Santa Ana Chamber of Commerce

David Girty, Managing Director, Aspect Real Estate Partners

Max Sabino, Associate, Aspect Real Estate Partners

Aspect Real Estate Partners | Date Uploaded: October 09, 2020

| Date Created: | Economics/Market Reports/Research, Events / Webinars, Government, Neighborhoods/Communities/Cities

| Office, Retail

| CALIFORNIA

FOR LEASE

50,000 - 100,000 SF Office

2300 SW 145th Ave, Miramar, FL 33027

Jonathan Kingsley

Executive Managing Director

+1 954 652 4610

jonathan.kingsley@colliers.com

Jarred Goodstein

Senior Director

+1 954 652 4617

jarred.goodstein@colliers.com

Ilyssa Ettelman

Associate

+1 954 652 4624

ilyssa.ettelman@colliers.com

VidTech1 | Date Uploaded: October 07, 2020

| Date Created: | Commercial Properties for Lease

| Office

| FLORIDA

1811 Fremont Drive

Canon City - CO

81212

Carolyn Carter

(719)351-1269

carolyn.carter@mountainpropertybuilders.com

VidTech1 | Date Uploaded: October 07, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| COLORADO

Office for Sale

Brentwood Sand Creek

181 & 200 Sand Creek Rd, Brentwood, CA 94513

Matt Hagar

VidTech1 | Date Uploaded: October 07, 2020

| Date Created: | Commercial Properties for Sale

| Office, Retail, Mixed-Use: Office / Retail

| CALIFORNIA

2960 W Grant Line Road, Tracy, CA 95304

For Sale

Bryan Wirt, 916-677-8151, bryan.wirt@tricommercial.com, DRE# 00665363

John Hynes, 916-677-8184, john.hynes@tricommercial.com, DRE# 02077645

Joe Garrison, 916-677-8146, joe.garrison@tricommercial.com, DRE# 02107849

VidTech1 | Date Uploaded: October 07, 2020

| Date Created: | Commercial Properties for Sale

| Retail

| CALIFORNIA

From this video:

Jay Olshonsky: Now, I can't remember any time in my lifetime where people weren't paying their rent on an apartment because they had lost their jobs in masses amounts like people have or they were getting, whether it's $400, $600, $800 from the US government a week to support themselves during this off cycle and the prospects of the next employment is not there. Plus, the governments have said, you can't evict them and then those have just been extended. So, a product type that traditionally was bulletproof: multifamily, I don't see how that's going to also be unscathed in this and certainly there were other things in multifamily in certain areas and I think I could use downtown Los Angeles, I certainly could use Nashville, where you had oversupply of class A apartments.

How will multifamily real estate perform in the current downturn? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Multifamily

| ALL

From this video:

Jay Olshonsky: And I said, well, two things. One, you might want to actually get bids on it to figure out what someone will pay you. Maybe someone will pay you seven, maybe someone will pay you four. And then there's another ugly thing out there that everyone forgets and you said you had worked at banks, so you'll understand this and lot of people forget there's this ugly thing called "debt forgiveness tax". And whenever you have debt forgiveness, you then get to bankruptcies and work-outs and then other ways of handing properties back for investors that invest in the property and whether that's an individual investor or a large scale investor. There's so many issues going around right now.

What does it look like when private capital steps in on real estate investment opportunities? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| ALL

| ALL

Jay Olshonsky: It might be a whole lot easier just to take those 50 loans to market and see what the private capital is willing to pay to buy those loans. At what discount? Now, could it be 20 cents on the dollar? Could it be 50 cents on the dollar? Could it be 60 cents? I don't know that and because there hasn't been enough distressed loan sales to actually say, OK, well, this portfolio of 50 loans sold at this discount, but it's coming, it's definitely coming.

How are distressed loan sales faring in the pandemic? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars, Lending / Finance

| Industrial, Multifamily, Office, Retail, ALL

| ALL

Jay Olshonsky: And why this is so different than 2009? The best example I can give you is, we had an economist from CoStar and I will quote him because I give him credit for this and he basically said, "this is at least 20 times worse than 2009". So, if you just take that volume and you look at it that way. If you really think of 2009, it was really starting in the mortgage-backed securities and housing and then it spread to the mortgage-backed securities in commercial real estate. This is spread to everywhere. This is the local bank. This is the biggest banks in the world.

Is the current real estate downturn different from 2009? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Industrial, Multifamily, Office, Retail, ALL

| ALL

Jay Olshonsky: And keep in mind, this can be a bank, this can be a CMBS servicer, this can be a private debt holder. This can be a mortgage REIT. This can be all kinds of different people holding that paper who will ultimately have to make a decision. Now so, I also think a lot of them are thinking, should we sell the actual notes of the properties and not go through the foreclosure? That, again, would delay the process. So that's how I kind of come up with my, let's say, 12, 6 to 18 months is sort of the range when some of these properties will start happening. Now, add one more thing. In the United States, most of the courts have been closed, so, if you're going to go the eviction route, or the foreclosure route, you're going to have to get in line.

Will the seemingly inevitable wave of distressed real estate assets hit the market soon? Watch this to find out.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Industrial, Medical, Multifamily, Office, Retail, ALL

| ALL

Today’s show came about after I read an article in Yahoo Finance about the timing of a wave of distressed real estate assets likely to hit markets. The article talked about this wave coming in 9 to 18 months from now, which would place it in the second quarter of 2021. And this is consistent with what other guests on the podcast have predicted, including Ethan Penner at Mosaic Real Estate Investors, for example, Greg Freedman at BH3, Willy Walker at Walker & Dunlop and others.

Considering how frequently this topic is discussed on the show, I figured it was time for an update and to hear from the brokerage industry. So I called on Jay Olshonsky.

Today's show is more focused on market conditions and predictions than it is on digital marketing. But we do venture into how to isolate opportunities during the current economic downturn and when you might expect them to come along.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

Find more insightful videos on the GowerCrowd YouTube channel here: http://bit.ly/YouTubeGowerCrowd

GowerCrowd | Date Uploaded: October 06, 2020

| Date Created: | Brokerage, Economics/Market Reports/Research, Events / Webinars

| Industrial, Medical, Multifamily, Office, Retail, ALL

| ALL

3501 SECTION ROAD, CINCINNATI, OHIO 45237

Dave Lockard, CCIM | Senior Vice President | +1 513 369 1347 | dave.lockard@cbre.com

Kurt Shoemaker | Senior Vice President | +1 513 369 1383 | kurt.shoemaker@cbre.com

Marianne Taylor | Associate | +1 513 369 1353 | marianne.taylor@cbre.com

VidTech1 | Date Uploaded: October 06, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| OHIO

460 Briarwood Dr, Jackson MS 39206

Office for Sale

SVN | Southgate Realty, LLC

Chamberlain Carothers, CCIM

John Blackledge, CCIM

Greg Brett

rimarketplace.com/auction/737/briarwood-one

VidTech1 | Date Uploaded: October 06, 2020

| Date Created: | Commercial Properties for Sale

| Office

| MISSISSIPPI

200 E Broward Blvd.

Fort Lauderdale, FL 33301

For Lease

Colliers International

Jarred Goodstein, Jonathan Kingsley, Ilyssa Ettelman

VidTech1 | Date Uploaded: October 06, 2020

| Date Created: | Commercial Properties for Lease

| Office

| FLORIDA

Take this one-minute aerial tour of Kilroy Realty's Oyster Point development.

Kilroy Realty Corp | Date Uploaded: October 06, 2020

| Date Created: | Commercial Properties for Lease, Development/Planning/Entitlements, Neighborhoods/Communities/Cities

| Hospitality, Office, Transportation, Sports & Entertainment, Education

| CALIFORNIA

View this fast paced overview of One Paseo by Kilroy Realty, the 1.1 msf mixed-use development in the Del Mar area of San Diego.

Kilroy Realty Corp | Date Uploaded: October 06, 2020

| Date Created: | Commercial Properties for Lease, Residential Properties for Lease, Neighborhoods/Communities/Cities

| Multifamily, Office, Retail, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail

| CALIFORNIA

Joseph W. Brady speaks his opposition to Proposition 15 (on California's November 3, 2020 ballot), explains the split role property tax, and warns of the disastrous impact if it passes.

The Bradco Companies | Date Uploaded: October 05, 2020

| Date Created: | Events / Webinars, Government, Legal, News

| ALL

| CALIFORNIA

RENTV Takes You To The Village at Santa Monica June 2012

RENTV | Date Uploaded: October 05, 2020

| Date Created: | Construction, Development/Planning/Entitlements, Historical

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| CALIFORNIA

visit our website: https://universalcommercialcapital.com/

Universal Commercial Capital | Date Uploaded: October 05, 2020

| Date Created: | Lending / Finance

| Land, Medical, Multifamily, Office, Retail

| CALIFORNIA

Universal Commercial Capital is one of the top private lenders in the USA, offering great rates, fast closing and great team to work with.

For more details or info please visit our website at:

http://universalcommercialcapital.com

Universal Commercial Capital | Date Uploaded: October 05, 2020

| Date Created: | Lending / Finance

| Land, Medical, Multifamily, Office, Retail, Other

| CALIFORNIA