VIDEO SEARCH

2421 videos found

Investment Summary:

• Iconic Coastal Location – 1 Block from Beach & 2 Blocks from Downtown Main Street

• Rare Offering – First Time On Market in 30+ Years

• Exceptional Unit Mix – All 2- & 3-Bedroom Townhome Floorplans (approx. 1,010 SF) with Private Patios

• Ample Parking – 16 Subterranean & 3 Single-Car Garages

• Year Built: 1976

• Total Building Size: ± 9,086 SF Agents:

Dan Blackwell

Lic. CA 01854961

Email: dan.blackwell@cbre.com

Phone: (949) 307-8319

Mike O'Neill

Lic. CA 02036937

Email: mike.oneill@cbre.com

Phone: (949) 809-3615

For more details visit: http://multifamilysocal.com/listings

CBRE Dan Blackwell | Date Uploaded: November 12, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

.We will continue to compile this survey on a monthly basis. Please contact us if you have any multifamily needs.

CBRE Dan Blackwell | Date Uploaded: November 12, 2020

| Date Created: | Residential Properties for Lease, Brokerage, Economics/Market Reports/Research

| Multifamily

| CALIFORNIA

If you would like to explore selling a multifamily asset, please click here the link below to schedule a call with Dan Blackwell.Agent: Dan Blackwell of CBRE

Lic. CA 01854961

Website: multifamilysocal.com

Email: dan.blackwell@cbre.com

Phone: (949) 423-6111

For more details visit: http://multifamilysocal.com/listings

CBRE Dan Blackwell | Date Uploaded: November 12, 2020

| Date Created: | Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Multifamily

| CALIFORNIA

We will continue to compile this survey on a monthly basis. Please contact us if you have any multifamily needs. Agent: Dan Blackwell of CBRE

Lic. CA 01854961

Phone: (949) 423-6111

Website: http://www.multifamilysocal.com

Email: dan.blackwell@cbre.com

CBRE Dan Blackwell | Date Uploaded: November 12, 2020

| Date Created: | Residential Properties for Lease, Brokerage, Economics/Market Reports/Research

| Multifamily

| CALIFORNIA

As we navigate the current market, we thought it would be helpful to provide survey results from active investors. Here are the results.Agent: Dan Blackwell of CBRE

Lic. CA 01854961

Website: multifamilysocal.com

Email: dan.blackwell@cbre.com

Phone: (949) 423-6111

For more details visit: http://multifamilysocal.com/listings

CBRE Dan Blackwell | Date Uploaded: November 12, 2020

| Date Created: | Commercial Properties for Lease, Brokerage, Economics/Market Reports/Research

| Multifamily

| CALIFORNIA

MoHall Commercial & Urban Development LLC is pleased to present an 18-unit mixed-use building, East of Chicago's south side historic neighborhood of Chatham. This building includes [2] 1Bed/1Bath [6] 2Bedroom/1Bath [4] 2 Bedroom/2Bath [6] Retail Spaces. Recent updates to the building include a new porch, roof, tuckpointing, electrical and windows. Units are individually heated. Do not miss the opportunity to add this turn-key income-producing building to your portfolio. Contact 312-826-9925

MoHall Commercial & Urban Development | Date Uploaded: November 11, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| ILLINOIS

Looking to invest into commercial real estate? But do not know where to start?

MoHall Commercial & Urban Development | Date Uploaded: November 11, 2020

| Date Created: | Brokerage, Educational Programs

| ALL

| ILLINOIS

3939 Chelsea Road West, Monticello MN 55362

Scott M. Schmitt, CCIM

Ph: +1 320 267 4576

E: Scott@CBCorion.com

VidTech1 | Date Uploaded: November 09, 2020

| Date Created: | Commercial Properties for Sale

| Retail, Automotive

| MINNESOTA

132 O'Hara Ave, Oakley, CA 94561

Property For Sale

VidTech1 | Date Uploaded: November 09, 2020

| Date Created: | Commercial Properties for Sale

| Retail

| CALIFORNIA

This show from August, 2013 takes the viewer to the Civic Center of Downtown Los Angeles, a bustling part of the city, to the high-profile site on the west side of Grand Avenue between 2nd and 3rd Streets. Here Related California was developing 225 N. Grand Avenue, a 19-story apartment tower that contains 271 units, with 20% of those affordable housing. 225 Grand was the first new apartment complex on Bunker Hill in more than a decade. The new high-rise is LEED Silver certified and was estimated to cost $120 Million to build. It was designed by Miami-based architecture firm Arquitectonica, with LARGE Architecture as the executive architect and Pankow as the general contractor.

RENTV | Date Uploaded: November 09, 2020

| Date Created: | Residential Properties for Lease, Architecture, Construction, Development/Planning/Entitlements, Historical

| Multifamily

| CALIFORNIA

This RENTV show from May, 2013 is about the mixed-use development within Playa Vista, called The Runway. This four-story project contains a 200,000-square-foot retail center, 420 apartments, 25,000 square feet of creative office space and 3 acres of open space, with a projected development cost of $260 million. It was developed by Lincoln Property Co. Phoenix Property Company and Paragon Commercial Group. The project was designed by renowned architecture firm Johnson Fain.

RENTV | Date Uploaded: November 09, 2020

| Date Created: | Development/Planning/Entitlements, Historical

| Multifamily, Office, Retail, Mixed-Use: Multifamily / Retail

| CALIFORNIA

This show from December, 2012 reports about the $105 million mixed-use Wilshire La Brea project under construction on the southeast corner of Wilshire and La Brea, at 5200 Wilshire. Located on the edge of the Miracle Mile district in the city of Los Angeles, the Wilshire La Brea apartment project, is being developed by BRE Properties. It will contain 478 apartments with 40,000 square feet of street-front retail and restaurant space in one of the hottest redevelopment neighborhoods in Los Angeles. BRE Properties broke ground in August 2012 and move-in was scheduled for second quarter 2014. It was designed by Los Angeles-based TCA architects, and is being built by general contractor Bernards.

RENTV | Date Uploaded: November 09, 2020

| Date Created: | Residential Properties for Lease, Construction, Development/Planning/Entitlements, Historical

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| CALIFORNIA

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

Today’s episode is special because apart from the crafty use of a ticker-tape soundtrack in the background, it's actually the first time I've ever done a breaking news podcast. Yesterday, I got an email from Mark Roderick, who is best known as the crowdfunding attorney. His website is crowdfundingattorney.com. And the email had two very important announcements from the SEC.

The first one covers commissions that you can potentially pay to someone who helps you find equity for your projects based on the amount of money that they actually raise for you. So it's a seismic change - big deal. And the second pertains to the addition of non-accredited investors and the way that they can be brought in to deals that would normally only be available to accredited investors. Very, very important news. This is absolutely breaking, brand new stuff.

Now, neither of these things are law yet. So to be clear on what we might expect, yesterday I called Mark and asked if he would join me on this podcast. And that's what you're going to hear about today. You're going to get the full scoop here first.

These changes are going to alter the landscape dramatically over the next few months, once these laws take effect. The opportunity for you to raise money for your deals and the tools that you will have available to you are going to dramatically increase. And so before they take effect, get ready for them by building up your website, by getting content on your website. So I do it now. Don't delay. Now is the time to act. They say that crowdfunding looks like a hockey stick in terms of why it's growing. Forget it. This is the neck of the hockey stick. The growth has barely started.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

$5.5 Million of Capital Raised on a $2 Million Capital Target (Real Estate Crowdfunding)

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: Yeah. So, actually our last deal that we had closed was back in April. And so, COVID-19, things are going on. We had a dry spell and so we just funded our most recent deal last week. And so, heading into the capital raise, we had this reservation open for months now. We were able to see that we had 5.5 million in reservations going into a 2 million dollar capital raise. So, we felt really good, right? It's a really nice position to be in. There's a certain level of certainty that, hey, we have the dollars lined up and so we could focus on due diligence, for example, or other parts of the deal.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

Early Experiences with Keen Real Estate Investors

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: It comes out of direct experience and I think a lot of our unique features are developed this way. But, back in 2013, 2014, when I was raising money for my own real estate deals. Still do today, of course. I was in that position where I wouldn't have a deal for a few months, but I kept having these new calls with new prospects, new investors and I was thinking... Because at that point they've already found me. They've signed up with me.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

How Sponsors Draw Interest to an Investment Reservation System

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: Yeah, it's through email. So there's a direct link to the reservation. And so, that way you can garner that interest. You can share that link via email. A lot of the times, your contacts, your investors, they'll end up sharing, forwarding along the email, right? And so, you're able to pick up referral leads through that as well. But, it's primarily through email.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

How Sponsors Can Attract Investors and Pre-Fund Real Estate Deals

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: Yeah, yeah. We found this very powerful. I found it directly very powerful because, of course, I raise money for my own deals. And so, we created the infrastructure where you can post a reservation directly through the platform. You can drive traffic to this reservation, all of your leads and prospective investors where they can basically get a teaser of the deal, what's to come, and they can place a reservation or a soft commit. Basically, they're getting on the waitlist for the deal when it's available to invest in because, of course, most real estate sponsors and developers, they're not.... most of the time they're not raising money.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

Tech Savvy Sponsors More Likely to Adopt Technology Changes (Real Estate Crowdfunding)

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: Yeah, hands down, those who are... who seem to be more tech savvy, who might have more polished looking websites, who are adopting technology, are fast movers. They are clients who will sign up and start using and subscribe and they self-serve through the entire process and when we ask them if they need help, they say, we love what you got here, nothing needed now. And then, the other end of that spectrum is someone who had their website built out, its a 20 year old website.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Technology / Proptech, REITs / Investment Funds

| ALL

| ALL

How Real Estate Sponsors Can Overcome Hurdles Through Automated Systems

Are you a developer? Learn How to Syndicate Real Estate Using the Power of Social Media in this free training: https://bit.ly/31tSh4h

Are you and investor? Watch this free webcast and discover the Hidden Secrets to Success in Real Estate Investing: https://bit.ly/2QpSAH2

From this video:

Jacob Blackett: Yeah, there's a couple of approaches to that. So our team has become very good at migration and onboarding. So, it's what we refer to as a "white glove service" where we set the infrastructure, we set up the data, we put everything in place so that the the developer or the sponsor, the real estate firm, they can come in and now just focus on how to use the tools. And, I think one thing that really differentiates us is that, it's simple and intuitive, the product that we've delivered. And so, a lot of early investor portals and currently, unfortunately, are a bit clunky and complicated. And so, I think that's a big holdback in what we've seen for people to adopt those current portals that are out there.

Visit the GowerCrowd website for masses of free real estate syndication and investing resources and training: https://bit.ly/31pWtSx

If you enjoyed this video, please leave a like rating and comment.

GowerCrowd | Date Uploaded: November 09, 2020

| Date Created: | Events / Webinars, Lending / Finance, REITs / Investment Funds

| ALL

| ALL

Lease Available Space

413 N Alafaya Trl, Orlando, FL 32828

Colette Santana

813-777-8611

colette.santana@am.jll.com

Billy Rodriguez

407-443-3925

billy.rodriguez@am.jll.com

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| FLORIDA

8990 Atlantic Avenue, South Gate, CA.

Paul Sablock

Managing Director

+1 213 239-6230

paul.sablock@am.jll.com

License #00783445

Joe Dimola:

Vice President

(213) 239-6228

joe.dimola@am.jll.com

License #01944484

Andrew Hotchkiss:

Associate

(213) 622-6222

andrew.hotchkiss@am.jll.com

License #02096746

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Lease

| Industrial

| CALIFORNIA

3600-3690 King Street,

Alexandria, VA 22302

Eric Collich

p: 301-907-7800

e: ecollich@firstwash.com

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| VIRGINA

311-359 Maple Ave, Vienna, VA 22180

Retail for Lease

First Washington Realty

Eric Collich

301-907-7800

ecollich@firstwash.com

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| VIRGINA

Media Park Santa Monica

1813 Centinela ave., 3212 Nebraska Ave., 3226 Nebraska Ave., 3232 Nebraska Ave

Office for Lease

Mitch Stokes

310.442.3395

mstokes@madisonpartners.net

License No. 01037526

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Lease

| Office

| CALIFORNIA

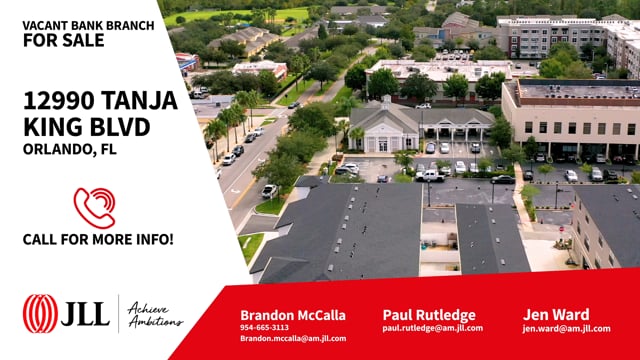

Vacant bank branch for sale

12990 Tanja King Blvd, Orlando, FL

32828

---

Brandon McCalla

JLL

954-665-3113

Brandon.mccalla@am.jll.com

Paul Rutledge

JLL

paul.rutledge@am.jll.com

Jen Ward

JLL

jen.ward@am.jll.com

VidTech1 | Date Uploaded: November 08, 2020

| Date Created: | Commercial Properties for Sale

| Retail

| FLORIDA

Marcus & Millichap | LAAA Team - New Construction Activity

Marcus & Millichap - LAAA Team | Date Uploaded: November 03, 2020

| Date Created: | Commercial Properties for Sale, Brokerage

| Multifamily

| CALIFORNIA

Just Listed | 6 Units | Pasadena | Huge Value Add | Lowest Price Per Unit on Market in Pasadena

Marcus & Millichap - LAAA Team | Date Uploaded: November 03, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

Just Listed | 5 Units | Prime West Los Angeles

Marcus & Millichap - LAAA Team | Date Uploaded: November 03, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

9 Units | Van Nuys | Brand New 2020 Construction | Qualified Opportunity Zone

Marcus & Millichap - LAAA Team | Date Uploaded: November 03, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

Just Listed | 22 Units | Prime Koreatown | Turn Key with Significant Upside

Marcus & Millichap - LAAA Team | Date Uploaded: November 03, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

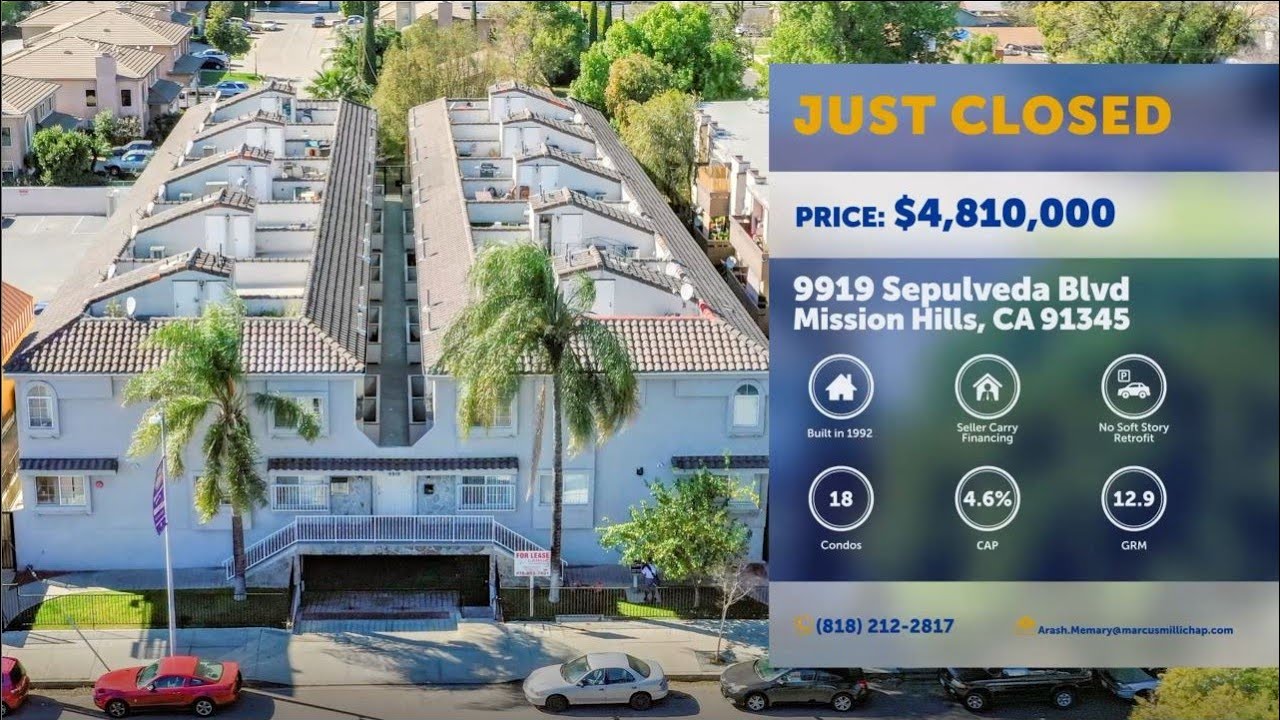

Court Ordered Sale | 1031 Exchange Buyer

Sold 18 Condos in a 20 Condo Building

Negotiated Seller Financing

Marcus & Millichap - LAAA Team | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale, Brokerage

| Multifamily

| CALIFORNIA

4.85% CAP | 14.21 GRM | $370,833 per Unit

Value Add Opportunity | Over 20% Upside in Rents

No Soft Story Retrofitting Required

Marcus & Millichap - LAAA Team | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

4.06% CAP | 16.74 GRM | $545/SF

All 10 Units are 2-Bed / 1-Bath

Soft Story Retrofitting Completed

Marcus & Millichap - LAAA Team | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

22 Units | Santa Monica | Value Add

Walking Distance to Santa Monica and Venice Beach

Soft Story Retrofitting Completed by Seller

Marcus & Millichap - LAAA Team | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

Retail for Lease

16500 - 16540 W 78th St B, Eden Prairie, MN 55346

First Washington Realty

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| MINNESOTA

5555 East River Rd, Tucson, AZ 85750

Retail for Lease

First Washington Realty

Jesse Peron

520-323-5130

jesse.peron@cbre.com

Jewel Snowden

301-907-7800

jsnowden@firstwash.com

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| ARIZONA

$625,000/Unit | 3.29% CAP | 18.57 GRM

1031 Exchange Buyer | All Cash Close

Closed During the Pandemic

Marcus & Millichap - LAAA Team | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale, Brokerage

| Multifamily

| CALIFORNIA

5474 Reservoir Drive, San Diego, CA 92120

CBRE

J. Kevin Mulhern

Senior Vice President

+1 858 646 4723

kevin.mulhern@cbre.com

Lic 00804871

Allen Chitayat

First Vice President

+1 858 546 2644

allen.chitayat@cbre.com

Lic 00894356

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| CALIFORNIA

1074 Park Lane, Middletown, Ohio 45042, United States

Emily Cantley

CBRE

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Sale

| Multifamily

| OHIO

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Lease

| Retail, Mixed-Use: Multifamily / Retail

| FLORIDA

RETAIL FOR LEASE: 5756 Pacific Ave & 5757 Pacific Ave, Stoctkon, CA, 95207

Retail For Lease

JLL

Dave White

VidTech1 | Date Uploaded: November 02, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| CALIFORNIA

In a RENTV news program from October, 2012, RENTV reports on the $165 mil Shores Project, at the time under construction in Marina del Rey. This striking new 544-unit apartment complex, designed by Nadel Architects, developed by Jerry Epstein's Del Rey Shores. In the exciting and fast-paced video show, you will get a quick history of the property as well as an on location look at the construction of this upscale residential community, which was scheduled for completion in August 2013.

RENTV | Date Uploaded: November 02, 2020

| Date Created: | Residential Properties for Lease, Construction, Development/Planning/Entitlements, Historical

| Multifamily

| CALIFORNIA

In this show from August, 2012, RENTV covers an exciting project, J.H. Snyder's The Vermont. Located at the high-traffic intersection of Wilshire and Vermont, The Vermont now consists of two modern high-rises containing 464 units that had an estimated cost of $200 million to build.

RENTV | Date Uploaded: November 02, 2020

| Date Created: | Residential Properties for Lease, Development/Planning/Entitlements, Historical

| Multifamily, Mixed-Use: Multifamily / Retail

| CALIFORNIA

In a very popular show from RENTV from January, 2012, the media company, in its inimitable style, reports on the development and recent sale of West 27th Place, an amazing student housing complex at the University of Southern California in Los Angeles.

Watch this program and not only will you learn about the transaction, but you will feel like you actually visited this LEED platinum project, which opened in August 2011, was developed by Symphony Development with an equity investment from CityView's Los Angeles Fund. It was bought by NY-based Kayne Anderson Real Estate Advisors for a price just over $60 million.

RENTV | Date Uploaded: November 02, 2020

| Date Created: | Residential Properties for Lease, Development/Planning/Entitlements, Historical

| Multifamily

| CALIFORNIA

1745 W. Market Street, Akron, Summit County, Ohio 44313

800-605-4966

info@fnrpusa.com

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Sale, REITs / Investment Funds

| Retail

| OHIO

8011 Fins Up Circle, Kissimmee, Florida 34747, United States

Office For Sale

thedowdcompanies

John W. Dowd III

Theresa Johnson

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Sale

| Office

| FLORIDA

PLAZA VENEZIA

W. 7760 Sand Lake Rd. Orlando, FL 32819

Jorge Rodriguez, CCIM

+1 407 362 6141

jorge.rodriguez@colliers.com

Chris Alders

+1 407 362 6142

chris.alders@colliers.com

Retail Shopping Center For Lease

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| FLORIDA

9500 SW 180 St Palmetto Bay, FL, 33157

Office For Lease

Andrew Rosenberg

Comras Company

305-968-8932

ARosenberg@ComrasCompany.com

comrascompany.com

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Office

| FLORIDA

Office For Lease

Colliers International

Contacts:

John Fricke

john.fricke@colliers.com

248.226.1887

Randall Book

randall.book@colliers.com

248.226.1816

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Office

| MICHIGAN

1045 Beaver Creek Commons Drive, Apex, North Carolina 27502

VidTech1 | Date Uploaded: October 25, 2020

| Date Created: | Commercial Properties for Lease

| Retail

| NORTH CAROLINA